Monday, May 29, 2006

Tulipomania Over Indonesia Emerging Markets

Collective behaviour come by themself without any interpretation

Collective behaviour come by themself without any interpretationOne give sugestive to the next and vice versa, through the next in kinds of circles. These circle sugestiveable would bring powerfully confidence positive or negative in kinds of self-hipnopse.

Gustav Le Bon called it as Collective Elementar ( Crowd) => collective unconcious could beat up individual concious which make them do irrational crazy things.

In other Words "Kinds of social contagion pushed people in irrational or collective excitement condition."

Here I have learned about JSX index bubbleing irrational against to real industry/economics condition, especially betwen Februar - mid of march.

To my observation it just product of technical reflection or an evitable fate of an overblown bubble economics over expectation after oilprice Crise.

People getting mad and just follow the index growth and do panic buying before they really understand they are all actually just build perception over mis-perception.

Perception influencing the Events and vice-versa. The market behaviourly tend to fluctuated wildly anytime and anywhere, since the Actors build their own perception on miss-perception.Miss-perception on these cases is certainity which influence the fact/reallity.

Market Failure happened when the gap between the perception and reallity is bigger and accumulated in the next failure before it come to Abnormal Curve condition. The curve reflected the Actors emotion whose questing "who will winning the Voting in influenced Crowd".

The Barrometer T Bills there & SBI here, Inflation there & here, Premium Risk there % here => indicating real investment here not as it supossed.

Example:

St. John Dance or St. Vitus Dance on XVII centuries.

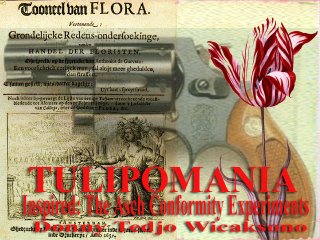

Related to Stock Market is Tulipomania - or Tulipmania in Netherlands where people dare to bough Tulip Seed at price of the same wage of Gold.

It took place in the first part of the 17th century, especially in 1636-37. By 1636, tulips were traded on the stock exchanges of numerous Dutch towns and cities. This encouraged trading in tulips by all members of society, with many people selling or trading their other possessions in order to speculate in the tulip market. Some speculators made large profits as a result.

Some traders sold tulip bulbs that had only just been planted or those they intended to plant (in effect, tulip futures contracts). This phenomenon was dubbed windhandel, or "wind trade", and took place mostly in the taverns of small towns using an occult slate system to indicate bid prices. State edict in 1610 made that trade illegal by refusing to enforce the contracts, but the legislation failed to curtail the activity.

In February 1637 tulip traders could no longer get inflated prices for their bulbs, and they began to sell. The bubble burst. People began to suspect that the demand for tulips could not last, and as this spread a panic developed. Some were left holding contracts to purchase tulips at prices now ten times greater than those on the open market, while others found themselves in possession of bulbs now worth a fraction of the price they had paid. Thousands of Dutch, including businessmen and dignitaries, were financially ruined.

Tulipomania A 2002 paper by UCLA's Earl A. Thompson and Jonathan Treussard, "The Tulipmania: Fact or Artifact?" an alternate explanation for Dutch tulip mania:

that it was not caused by irrational speculation, but rather by a Dutch parliamentry decree (originally sponsored by Dutch investors made skittish by the Thirty Years' War then in progress) that made the purchase of tulip-bulb "futures contracts" a nearly risk-free proposition:

...they tell us that, on February 24, 1637, the self-regulating guild of Dutch florists, in a decision that was later ratified by the Dutch Parliament, announced that all futures contracts written after November 30, 1636 and before the re-opening of the cash market in the early Spring, were to be to [sic] interpreted as option contracts. They did this by simply relieving the futures buyers of the obligation to buy the future tulips, forcing them merely to compensate the sellers with a small fixed percentage of the contract price.

Happy Crazy Crowder

NOTE:

Solomon Asch experiment (1958) A study of conformity , if you don't beleives the Theory you ought learned to be a good Provocators.

<< Home